UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Nexstar Media Group, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | No fee |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

2022 Annual Meeting of Stockholders │ Meeting Notice │ Proxy Statement

proxy

YOUR VOTE IS IMPORTANT

NEXSTAR MEDIA GROUP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 3, 2020[●], [●], 2022

NOTICE IS HEREBY GIVEN that the Annual MeetingTO THE STOCKHOLDERS OF NEXSTAR MEDIA GROUP, INC.:

The 2022 annual meeting of Stockholdersstockholders (the “Annual Meeting”) of Nexstar Media Group, Inc. (the “Annual Meeting”“Company”) will be held on [●], [●], 2022, at Nexstar Media Group, Inc.’s principal executive offices at:

Nexstar Media Group, Inc.

The Summit

545 E. John Carpenter Freeway

Suite 120

Irving, Texas 75062

Wednesday, June 3, 2020

10:00 a.m., Central Daylight Time, in the building’s conference center, Suite 120, at the Company’s principal executive offices located at 545 E. John Carpenter Freeway, Irving, Texas 75062.

We intendThe Annual Meeting will be held for the following purposes:

1. | To elect directors to serve as Class I Directors for a term of three years. |

2. | To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022. |

3. | To conduct an advisory vote on the compensation of our Named Executive Officers. |

5. | To transact any other business which may properly come before the meeting. |

Nexstar Media Group, Inc. is mailing this Proxy Statement and the related proxy materials on or about [●] [●], 2022 to its stockholders of record as of the close of business on [●], 2022. Only stockholders of record at that time are entitled to receive notice of or to vote at the Annual Meeting and any adjournment or postponement thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder who provides proof of ownership on the date of the Annual Meeting during ordinary business hours at 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062 and for 10 days prior thereto.

The Company intends to hold our annual meetingits Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation and areperson but is sensitive to the public health and travel concerns that our stockholders may have and the protocols that federal, state and local governments have and may impose.continue to impose regarding the COVID-19 pandemic. In the event it is not possible or advisable to hold our annual meetingthe Annual Meeting in person, wethe Company will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication.a virtual-only platform or adding a webcast component to the in-person meeting. If we takethe Company takes this step, wethe Company will announce the decision to do so in advance by issuing a press release and filing such press release as definitive additional soliciting material with the Securities and Exchange Commission. WeThe Company will also make thatthis additional soliciting material available at http://www.astproxyportal.com/ast/13194/.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON [●], 2022:

The Company’s Proxy Statement for the Annual Meeting, 2021 Annual Report on Form 10-K and Form of Proxy Card are available at http://www.astproxyportal.com/ast/13194/.

TheYour vote is very important. Regardless of whether you plan to attend the Annual Meeting, we encourage you to vote as soon as possible by one of three convenient methods to ensure your shares are represented at the Annual Meeting: (1) accessing the internet site listed on the notice of internet availability of proxy materials or proxy card, (2) calling the toll-free number listed on the notice of internet availability of proxy materials or proxy card, or (3) signing, dating and returning the proxy card in the enclosed postage-paid envelope. Any proxy you give will not be held forused if you attend the following purposes:Annual Meeting and cast your vote during the meeting.

|

|

|

|

|

|

|

|

|

Nexstar Media Group, Inc. is mailing this Proxy Statement and the related proxy on or about May 4, 2020 to its stockholders of record on April 22, 2020. Only stockholders of record at that time are entitled to receive notice of or to vote at the Annual Meeting and any adjournment or postponement thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose germane to the Annual Meeting, at the Annual Meeting and for ten days prior to the Annual Meeting during ordinary business hours at 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062.

By Order of the Board of Directors |

|

/s/ Elizabeth Ryder |

|

Elizabeth Ryder |

Secretary |

|

|

IF YOU DO NOT EXPECT TO BE PRESENT AT THIS MEETING AND WISH YOUR SHARES OF COMMON STOCK TO BE VOTED, YOU ARE REQUESTED TO SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY WHICH IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. A RETURN ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES IS ENCLOSED FOR THAT PURPOSE.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 3, 2020:

The Proxy Statement and the Company’s 2019 Annual Report on Form 10-K are available at

http://www.astproxyportal.com/ast/13194/

PROXY STATEMENT TABLE OF CONTENTS

| 1 | |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

17 | ||

18 | ||

|

|

|

|

| |

|

|

|

|

| |

20 | ||

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

| |

| ||

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

39 | ||

|

|

|

|

| |

39 | ||

40 | ||

40 | ||

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

73 |

Nexstar Media Group, Inc. | i | 2022 Proxy Statement |

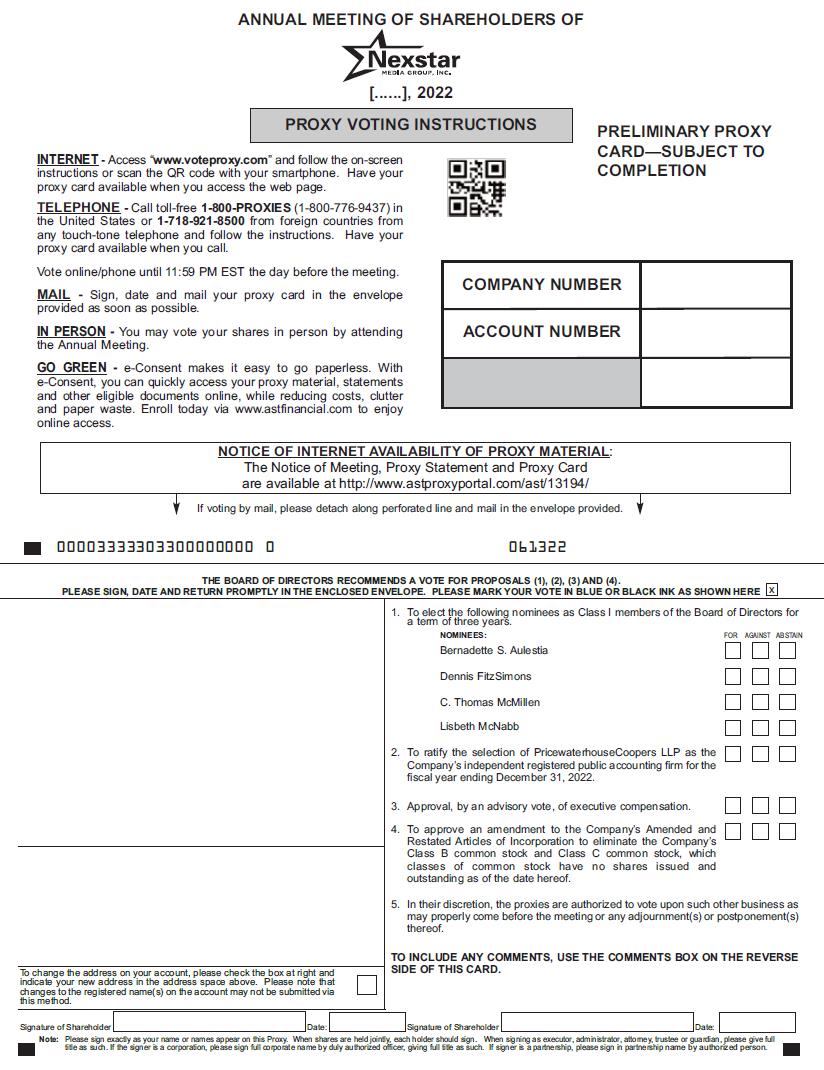

This Proxy Statement is furnished in connection with the solicitation by and on behalf of the Board of Directors of Nexstar Media Group, Inc., a Delaware corporation (“Nexstar,” the “Company,” “our,” “us,” or “we”), of proxies for use at Nexstar’s Annual Meeting of Stockholders to be held, pursuant to the accompanying Notice of Annual Meeting, on Wednesday, June 3, 2020[●], [●], 2022 at 10:00 a.m., Central Daylight Time, and at any adjournment or postponement thereof (the “Annual Meeting”). Actions will be taken at the Annual Meeting to (1) elect directors to serve as Class II directorsI Directors for a term of three years; (2) ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2020;2022; (3) advise the Board of Directors on the compensation of our Named Executive Officers; (4) approve an amendment to the Amended and (4)Restated Certificate of Incorporation to eliminate the Company’s Class B Common Stock and Class C Common Stock, which classes of common stock have no shares issued and outstanding, and (5) transact any other business which may properly come before the meeting.Annual Meeting.

Shares of Nexstar common stock, par value $0.01 (“Common Stock”), represented by a properly executed proxy that are received by Nexstar prior to the Annual Meeting, will, unless revoked, be voted as directed in the proxy. If a proxy is signed and returned, but does not specify how the shares represented by the proxy are to be voted, the proxy will be voted (i) FOR the election of the nominees named therein; (ii) FOR PricewaterhouseCoopers LLP as Nexstar’s independent registered public accounting firm in 2020;2022; (iii) FOR the approval, by non-binding vote, of executive compensation; (iv) FOR the approval of an amendment to the Amended and (iv)Restated Certificate of Incorporation to eliminate the Company’s Class B Common Stock and Class C Common Stock, which classes of common stock have no shares issued and outstanding, and (v) in such manner as the persons named in your proxy card shall decide on any other matters that may properly come before the Annual Meeting.

This Proxy Statement, the accompanying notice and the enclosed proxy card are first being mailed to stockholders on or about May 4, 2020.[●] [●], 2022.

Voting Securities

Stockholders of record on April 22, 2020[●], 2022 may vote at the Annual Meeting. On that date, there were 45,262,874[●] shares of the Company’s Class A common stock (“Class A Common StockStock”) outstanding and no shares of Class B Common Stock, Class C Common Stock or Preferred Stock outstanding. The holders of Class A Common Stock are entitled to one vote per share and the holders of Class B Common Stock, of which there are none, are entitled to 10 votes per share. Holders of our Class C Common Stock and Preferred Stock, of which there are none, have no voting rights. Under the Company’s By-laws,Amended and Restated Bylaws, adopted as of January 30, 2020 (the “bylaws”), the holders of a majority of the voting power of the outstanding shares of commoncapital stock entitled to vote at the Annual Meeting, present in person or represented by proxy, constitute a quorum. There is no cumulative voting. Abstentions, withhold votes and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NASDAQ rules to vote your shares on the ratification of PricewaterhouseCoopers LLP even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of directors, and the approval of executive compensation and the approval of an amendment to the Company’s amended certificate of incorporation without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

Nexstar Media Group, Inc. | 1 | 2022 Proxy Statement |

Voting Matters

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting

The following information can be found at http://www.astproxyportal.com/ast/13194/:

Notice of Annual Meeting and Proxy Statement;

2021 Annual Report on Form 10-K; and

Form of Proxy Card.

Voting Instructions

Stockholders of record may vote their proxies vote:

by the internet at http://www.voteproxy.com and following the proxy voting instructions listed on your proxy card;

by telephone at 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries as directed on the proxy card;

by signing, dating and returning the enclosed Proxy Card.proxy card via mail; or

by attending the Annual Meeting in-person and voting.

Each proxy that is properly received by Nexstar prior to the Annual Meeting will, unless validly revoked, be voted in accordance with the instruction given on such proxy. If a stockholder voted by signing and returning the proxy card via mail and no instructions are indicated, the shares represented by such proxy will be voted according to the recommendations of the Board of Directors. Each proxy that is properly received by Nexstar prior to the Annual Meeting will, unless revoked, be voted in accordance with the instructions given on such proxy. Any stockholder giving a proxy prior to the Annual Meeting has the power to revoke it at any time before it is voted by a written revocation received by the Secretary of Nexstar or by executing and returning a proxy bearing a later date.

Any stockholder of record attending the Annual Meeting may vote in person, whether or not a proxy has been previously given, but the mere presence of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy. In addition, stockholders whose shares of Common Stock are not registered in their own name, including shares held in a brokerage account, will need to obtain a legal proxy from the record holder of such shares to vote in person at the Annual Meeting.

You may revoke your proxy and change your vote by:

signing and properly submitting another proxy with a later date that is received before the polls close at the Annual Meeting;

voting by the internet or telephone on or before 11:59 p.m., Eastern Standard Time, on [●], 2022;

giving written notice of revocation of the stockholder’s proxy to the Company’s Corporate Secretary, prior to the Annual Meeting; or

voting in-person at the Annual Meeting.

Nexstar Media Group, Inc. | 2 | 2022 Proxy Statement |

Voting Matters

Votes Necessary to Approve Proposals

Proposal 1: Election of Class III Directors

On January 30, 2020, the Board of Directors of Nexstar Media Group, Inc. approved amendments to, and restated, the Company’s Amended and Restated Bylaws which became effective immediately upon approval. The principal changes to the Bylaws include the majority voting in uncontested director elections, instead of plurality voting.

In an uncontested election, each director shall be elected by a majority of the votes cast, and stockholders may cast their votes may be cast in favor of (i) “for” the nominee, (ii) “against” the nominee or withheld.(iii) abstain. A majority means that the number of shares voted in favor of “for” a nominee’snominee’s election must exceed the number of votes cast “against” that nominee’s election. Votes for and against a nominee’s election will count in the tabulations of votes cast on that nominee’s election. Withhold votesAbstentions and broker non-votes will not count on the tabulations of votes cast on a nominee’s election, will not be counted as a vote cast either “for” or “against” a nominee election and will therefore not affect the outcome of such vote because withhold votes and broker non-votes are not treated as votes cast..

In a contested election under our bylaws where the number of nominees for director exceeds the number of directors to be elected as of a date that is 14 days in advance of the date that the Company files its definitive proxy statement, each director shall be elected by a plurality of the votes cast, and votes may be cast in favor of the nominee or withheld. A plurality means that the nominee receiving the most votes for election to a director position is elected to that position. Withhold votes and broker non-votes will not affect the outcome of such vote, because withhold votes and broker non-votes are not treated as votes cast.cast on a nominee’s election.

This election is uncontested.

Proposal 2: Ratification of the Selection of Independent Registered Public Accounting Firm

The ratification of the selection of our independent registered public accounting firm requires the affirmative vote of a majority of the votes castvoting power of the shares of stock present in person or represented by proxy at the meeting.meeting and voting thereon. Votes may be cast for or against such ratification. Stockholders may also abstain from voting. AbstentionsVotes for and against this proposal and abstentions will count in the tabulations of votes cast on this proposal, while broker non-votes are notproposal. Abstentions will be counted as votes cast on this proposal and will have the same effect as votes “against” this proposal. If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NASDAQ rules to vote your shares on this proposal even if the broker does not receive voting instructions from you, and therefore no effect on the voting results.broker non-votes are expected in connection with this proposal.

Proposal 3: Advisory Vote on the Compensation of our Named Executive Officers

This vote is advisory only and non-binding toon the Board of Directors. The Board of Directors will receive the count of votes cast and expects to consider the results of the vote, along with other relevant factors, in its assessment of executive compensation. AbstentionsVotes may be cast for or against such proposal. Stockholders may also abstain from voting. Votes for and against this proposal and abstentions will count in the tabulations of votes cast on this proposal, while broker non-votes arewill not be counted as votes cast on this proposal and will have no effect on the voting results.

Proposal 4: Approval for the Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate Class B Common Stock and Class C Common Stock classes

The approval to amend the Amended and Restated Certificate of Incorporation to eliminate the Company’s Class B Common Stock and Class C Common Stock, which classes of common stock have no shares issued and outstanding, requires the affirmative vote of the holders of a majority in voting power of the outstanding shares of capital stock. Votes may be cast for or against such an amendment. Stockholders may also abstain from voting. Abstentions and broker non-votes will have the same effect as votes “against” this proposal.

Nexstar Media Group, Inc. | 3 | 2022 Proxy Statement |

PROPOSAL 1

PROPOSAL 1 – ELECTION OFOF CLASS III DIRECTORS

Our By-lawsbylaws provide for a classified Board of Directors, divided into three staggered classes – I, II and III. The terms of office for each of these classes are scheduled to expire on the date of our annual stockholders’ meeting in 2022, 20202023 and 2021,2024, respectively. At the 2020 Annual Meeting,annual meeting, all of our class II directorsClass I Directors are up for election.

The Board of Directors has nominated Messrs.Ms. Bernadette S. Aulestia, Mr. Dennis A. Miller, John R. MuseJ. FitzSimons, Mr. C. Thomas McMillen, and I. Martin PompadurMs. Lisbeth McNabb as nominees for election as our class II directors.Class I Directors. Once elected, each of our class II directors’Class I Directors’ terms will expire on the date of our 20232025 annual stockholders’ meeting. The persons named in the enclosed proxy will vote to elect as class II directorsClass I Directors the nominees named below, unless the proxy is marked otherwise. If a stockholder returns a proxy without contrary instructions, the persons named as proxies therein will vote to elect as Directors the nominees named below.

The Board of Directors recommends a vote FOR the selection of Messrs. Dennis A. Miller, John R. Muse and I. Martin Pompadur to the Board of Directors.

|

|

|

|

|

|

|

|

|

| 4 | 2022 Proxy Statement |

Proposal 1 - Election of Directors

CLASS I DIRECTOR NOMINEES | ||

|

| |

Bernadette S. Aulestia Chief Revenue & Growth Officer of Callisto Media and Former President, Global Distribution at HBO Age: 49 Board Tenure: 1 year Independent Director Nexstar Board Committee: Compensation Other Current Public Company Boards: | Ms. Aulestia was appointed a member of the Board of Directors of Nexstar Ms. Aulestia has served since March 2022 as Chief Revenue and Growth Officer of Callisto Media (private), a technology and media company which leverages audience data to create high-quality content at scale. From Ms. Aulestia currently serves on the board of directors and on the compensation and incentives committee of the board of directors of Denny's Corporation (NASDAQ: DENN), the franchisor and operator of one of America's largest full-service restaurant chains, and Candoo Tech (private), a monthly subscription-based technical customer support service for aging adults and planned communities. Ms. Aulestia’s qualifications to serve on Nexstar’s Board of Directors include her extensive experience as an operating executive in content and digital businesses which enables her to provide valuable advice on strategic and business matters as it relates to the Company’s own content and digital operations and growth plans. | |

Nexstar Media Group, Inc. | 5 | 2022 Proxy Statement |

Proposal 1 - Election of Directors

CLASS I DIRECTOR NOMINEES | ||

Principal Occupation and Selected Business Experience | ||

Dennis J. FitzSimons Chairman of Robert R. McCormick Foundation and Former Chief Executive Officer of Tribune Company Age: 71 Board Tenure: 5 years Independent Director Nexstar Board Committee(s): Audit Other Current Public Company Boards: | Mr. FitzSimons was appointed a member of the Board of Directors of Nexstar in January 2017 and serves on the Audit Committee. Mr. FitzSimons currently serves as Chairman of the Robert R. McCormick Foundation (non-profit), a charitable organization with extensive assets where he has held his position since 2004. Concurrent with and prior to that, Mr. FitzSimons spent 25 years with the Tribune Company, a predecessor company of Tribune Media Company which Nexstar acquired in 2019, most recently serving as the Chief Executive Officer and board member of Tribune Company from 2003 to 2007 and as Chairman of the board of directors from 2004 to 2007. From 2009 until January 2017, Mr. Mr. FitzSimons’ qualifications to serve on

| |

| ||

Nexstar Media Group, Inc. | 6 | 2022 Proxy Statement |

Proposal 1 - Election of Directors

CLASS I DIRECTOR NOMINEES | ||

|

| Principal Occupation and Selected Business Experience |

President and Chief Executive Officer of LEAD1 Age Board Tenure: 7 years Independent Director Nexstar Board Committee: Nominating and Corporate Governance Other Current Public Company Boards: |

| Mr. Mr. From 1987 through 1993, Mr. Mr. |

| ||

Nexstar Media Group, Inc. | 7 | 2022 Proxy Statement |

Proposal 1 - Election of Directors

CLASS I DIRECTOR NOMINEES | ||

Principal Occupation and Selected Business Experience | ||

Lisbeth McNabb Former Chief Financial Officer and Chief Operating Officer of Linux Foundation Age: 61 Board Tenure: 16 years Independent Director Nexstar Board Committee: Audit Other Current Public Company Boards: | Ms. McNabb was appointed a member of the Board of Directors of Nexstar in May 2006, serves on the Audit Committee and was the former Audit Committee Chairperson. Ms. McNabb served as the Chief Financial Officer and Chief Operating Officer of Linux Foundation, an open-source technology consortium, from 2018 to 2020. In 2017, Ms. McNabb was interim Chief Financial Officer for Illuminate Education and from 2012 to 2015 was Founder of DigiWorksCorp, a digital and data analytics SaaS company for retail and enterprise companies. Prior to that, she held positions with w2wlink, Match, Sodexo, PepsiCo Frito-Lay, American Airlines, AT&T and JP Morgan Chase. Ms. McNabb is also an independent director, chair of audit, member of the nominating and governance and compensation committees of NeoGames (NASDAQ: NGMS), a global provider of iLottery solutions for national and state-regulated lotteries, and an independent director and chair of the audit committee of Acronis (private), a global leader in cybersecurity and data protection. Previously Ms. McNabb served as a director and chair of the audit committee and on the compensation committee of Tandy Brands (public). She also previously served on the advisory board of American Airlines. Ms. McNab’s qualifications to serve on Nexstar’s Board of Directors include her leadership skills in entrepreneurial and executive roles in media, digital and technology companies. She is an expert at driving finance, strategy, operations, data analytics and revenue strategies at the high growth scaling inflection stage. | |

Nexstar Media Group, Inc. | 8 | 2022 Proxy Statement |

RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders, the Audit Committee of the Board of Directors has selected the firm of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2020.2022. PricewaterhouseCoopers LLP has served as our independent registered public accounting firm since 1997. If the stockholders do not ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm, the selection of such independent registered public accounting firm will be reconsidered by the Audit Committee.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do soMeeting and will be available to respond to appropriate questions from stockholders.

The Board of Directors believes that the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the year ending December 31, 2020 is in the best interests of the Company and its stockholders and therefore recommends that the stockholders vote FOR this proposal.

| The Board of Directors believes that the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the year ending December 31, 2022 is in the best interests of the Company and its stockholders and therefore recommends that the stockholders vote FOR this proposal. | |

Nexstar Media Group, Inc. | 9 | 2022 Proxy Statement |

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Board of Directors is asking stockholders to cast an advisory, non-binding vote to approve the compensation of our Named Executive Officers, as disclosed in the Compensation Discussion and Analysis section of this Proxy Statement. While this vote is non-binding, the Board of Directors values the opinions of Nexstar’s stockholders and expects towill consider the outcome of the vote, along with other relevant factors, when making future compensation decisions. Following the results of the shareholderstockholder advisory vote on the frequency of executive compensation voting at the 2017 annual meeting, the Company’s Board of Directors has approved the Company holding the stockholder advisory vote on the compensation of the Company’s Named Executive Officers annually until the next vote on the frequency of the advisory vote on executive compensation. The next advisory vote on frequency will occur at our 2023 annual meeting.

As described in detail in the Compensation Discussion and Analysis section, the Compensation Committee oversees the program and compensation awarded to Company executives, adopting changes to the program and awarding compensation as appropriate to reflect Nexstar’s circumstances.

The Board of Directors is asking Nexstar’s stockholders to indicate their support for the compensation of its Named Executive Officers. The Board of Directors believes that the information provided in the Proxy Statement demonstrates that Nexstar’s executive compensation program wasis designed appropriately and is working to ensure that management’s interests are aligned with its stockholders’ interests to support long-term value creation.

You may vote for or against the following resolution, or you may abstain. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officersNamed Executive Officers and the philosophy, policies and procedures described in this Proxy Statement.

| The Board of Directors believes, based on the analysis and recommendations performed by the Compensation Committee, as discussed in the Compensation Discussion and Analysis section of this Proxy Statement, that it has provided a reasonable compensation structure for the Company’s Named Executive Officers, in order to align their personal interests with that of the Company and to attract and retain their talent. The Board of Directors recommends that the stockholders vote FOR such compensation. | |

Nexstar Media Group, Inc. | 10 | 2022 Proxy Statement |

APPROVAL FOR THE AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

Subject to approval by the stockholders, our Board of Directors believes, based onhas approved the analysis and recommendations performed by the Compensation Committee, as discussed in the Compensation Discussion and Analysis section of this Proxy Statement, that it has provided a reasonable compensation structure foramendment to the Company’s Named Executive Officers, in orderAmended and Restated Certificate of Incorporation to align their personal interests with thateliminate the Company’s Class B Common Stock and Class C Common Stock classes. As of [●], 2022, Nexstar had approximately [●] million shares of Class A Common Stock outstanding and no shares of Class B Common Stock or Class C Common Stock outstanding. There are no shares of Class B Common Stock and Class C Common Stock registered under the Company and to attract and retain their talent. The BoardSecurities Act of Directors recommends that1933, as amended, or the stockholders vote FOR such compensation.Exchange Act. Nexstar’s Class A Common Stock has been the only class of shares outstanding since 2013.

| The Board of Directors believes that the proposed plan to amend the Company’s Amended and Restated Certificate of Incorporation to eliminate the Class B Common Stock and Class C Common Stock will benefit its stockholders. The Board of Directors believes it is not necessary for the Company to have these two classes of common stock since (i) no share of these classes is outstanding and (ii) the Company does not intend to issue any shares thereunder. The Board of Directors recommends that the stockholders vote FOR this proposal. | |

Nexstar Media Group, Inc. | 11 | 2022 Proxy Statement |

The current directors of the Company are:

|

|

| Nexstar Position | Class I Directors | Class II Directors | Class III Directors | ||||||

Perry A. Sook |

| Chairman and Chief Executive Officer |

|

|

|

| ✔ | |||||

Geoff Armstrong |

|

|

|

|

|

| ✔ | |||||

Bernadette S. Aulestia | Independent Director | ✔ | ||||||||||

Dennis J. FitzSimons | Independent Director | ✔ | ||||||||||

Jay M. Grossman |

|

|

|

|

|

| ✔ | |||||

C. Thomas McMillen | Independent Director | ✔ | ||||||||||

Lisbeth McNabb | Independent Director | ✔ | ||||||||||

Dennis A. Miller |

|

|

|

|

|

| ||||||

John R. Muse |

|

|

|

|

|

| ||||||

I. Martin Pompadur |

|

|

|

|

| ✔ |

DIRECTORS | ||

Principal Occupation and Selected Business Experience | ||

Perry A. Sook Age: 64 Board Tenure: 26 years Chairman Nexstar Board Committee: Other Current Public Company Boards: | Perry A. Sook has served as the Chairman and Chief Executive Officer of Nexstar since its inception in 1996. Mr. Sook currently serves as Chairman of The Ohio University Foundation Board of Trustees (non-profit), on the Board of Directors of Broadcast Music, Inc. (non-profit), the Broadcasters Foundation of America (non-profit), the Television Bureau of Advertising (non-profit) and as the Television Chairman for the National Association of Broadcasters (non-profit). Mr. Sook’s qualifications to serve on Nexstar’s Board of Directors include his demonstrated leadership skills and extensive operating executive experience in building Nexstar from its founding to $4.6BN of net revenue in 2021. He is highly experienced in driving operational excellence, innovating new strategies and attaining financial objectives under a variety of economic and competitive conditions. | |

Nexstar Media Group, Inc. | 12 | 2022 Proxy Statement |

Directors

DIRECTORS | ||

Principal Occupation and Selected Business Experience | ||

Geoff Armstrong Age: 64 Board Tenure: 18 years Independent Director Nexstar Board Committee: Other Current Public Company Boards: | Geoff Armstrong was appointed a member of the Board of Directors of Nexstar in November 2003, serves as the Chairman of the Audit Committee and was the former Chairman of the Compensation Committee and as the Chairman of the Audit Committee prior to Ms. McNabb’s tenure as Audit Committee Chairperson. Mr. Armstrong currently serves as Chief Executive Officer of 310 Partners, a private investment firm. From March 1999 through September 2000, Mr. Armstrong was the Chief Financial Officer of AMFM, an NYSE publicly traded company. From June 1998 to February 1999, Mr. Armstrong was Chief Operating Officer and a director of Capstar Broadcasting Corporation, which merged with AMFM in July 1999. Prior to that, Mr. Armstrong was a founder of SFX Broadcasting, which went public in 1993, and subsequently served as Chief Financial Officer, Chief Operating Officer and a director until the company was sold in 1998 to AMFM. Mr. Armstrong currently serves as the chairman of the audit committee of Urban One, Inc. (NASDAQ: UONE) and previously served as board member and chairman of the audit committee of Urban One, Inc. from June 2001 and May 2002, respectively, through November 2020. Mr. Armstrong’s qualifications to serve on Nexstar’s Board of Directors include his extensive experience as the Chief Financial and Chief Operating Officer in the broadcast and communications industry, as well as a board member of several publicly traded companies. His service on the boards of other public companies allows him to offer a broad perspective on corporate governance, risk management and operating issues facing corporations today. | |

Bernadette S. Aulestia | Biographical information for Ms. Aulestia can be found under “Proposal 1 – Election of Class | |

Dennis J. FitzSimons |

|

|

|

| |

|

| |

Nexstar Media Group, Inc. | 13 | 2022 Proxy Statement |

Directors

DIRECTORS | ||||

Principal Occupation and Selected Business Experience | ||||

Jay M. Grossman Age: 62 Board Tenure: 25 years Independent Director Nexstar Board Committee: Other Current Public Company Boards: | Jay M. Grossman was appointed a member of the Board of Directors of Nexstar in 1997 and serves on the Compensation Committee. Mr. Grossman currently serves as Managing Partner and Co-Chief Executive Officer at ABRY Partners, LLC (“ABRY”), a private equity fund focused on media, communications, business and information services, which he joined in 1996. ABRY helped found Nexstar alongside Perry Sook in 1996 and fully exited its ownership position in the Company in 2013. Mr. Grossman has served on the board of directors of a wide variety of companies including Atlantic Broadband, Caprock Communications, Consolidated Theaters, Cyrus One Networks, Donuts, Executive Health Resources, Grande Communications, Hosted Solutions, Monitronics International, Q9 Networks, RCN Telecom Services, Sidera Networks and WideOpenWest Holdings. Mr. Grossman’s qualifications to serve on Nexstar’s Board of Directors include his long-term experience with Nexstar and his extensive experience in investing in media and communications companies enabling him to provide meaningful insight and guidance to the Company and the Board as Nexstar executes on its growth plan. | |||

C. Thomas McMillen |

|

| ||

|

|

| ||

Lisbeth McNabb |

|

| ||

|

| |||

|

| |

Nexstar Media Group, Inc. | 14 | 2022 Proxy Statement |

Directors

DIRECTORS | ||

Principal Occupation and Selected Business Experience | ||

Dennis A. Miller Age: 64 Board Tenure: 8 years Independent Director Nexstar Board Committee: Other Current Public Company Boards: | Dennis A. Miller was appointed a member of the Board of Directors of Nexstar in February 2014 and serves as the Chairman of the Compensation Committee. Mr. Miller currently serves as the Chairman of Industrial Media, an independent production group which companies produce over 63 shows across 32 networks annually including “American Idol”, “So You Think You Can Dance”, and the “90 Day Fiancé” franchise as well as launching the music careers of platinum artists including Kelly Clarkson, Carrie Underwood, Daughtry, Phillip Phillips, Lauren Alaina and Maddie Poppe, which he joined in 2017. In March 2022, Industrial Media announced the sale of the company to Sony Pictures Television and Mr. Miller will step down as Chairman of Industrial Media upon closing. Prior to joining Industrial Media, Mr. Miller held senior executive positions at TV Guide Network, Turner Network Television, Sony Pictures and Lionsgate Television and acted as a venture capitalist investing in companies such as College Sports Television, TVONE, Capital IQ and K-12. More recently he was a General Partner in Spark Capital, whose investments include companies such as Twitter, Tumblr, Adaptv, Wayfair, Square, Slack, Cruise and Oculus Rift. Mr. Miller’s qualifications to serve on Nexstar’s Board of Directors include his extensive experience and executive roles in media and communications companies. | |

John R. Muse Age: 71 Board Tenure: 5 years Independent Director Nexstar Board Committee: Other Current Public Company Boards: | John R. Muse was appointed a member of the Board of Directors of Nexstar in January 2017 and serves on the Nominating and Corporate Governance Committee. Mr. Muse has over 25 years of experience in private equity and is currently the chairman of the board of directors of Lucchese, Inc. (private), a boot company, and Free Flow Wines (private), a leading packaging and logistics company serving the wine on tap segment. He is also on the board of directors of CSM Bakery Solutions (private) and from 2014 until January 2017, served on the board of directors of Media General (formerly public), which Nexstar acquired in 2017. Mr. Muse’s qualifications to serve on Nexstar’s Board of Directors include his investing, financial and leadership skills in entrepreneurial and executive roles in a wide range of industries in which he has invested directly and indirectly. | |

Nexstar Media Group, Inc. | 15 | 2022 Proxy Statement |

Directors

DIRECTORS | ||

Principal Occupation and Selected Business Experience | ||

I. Martin Pompadur Age: 86 Board Tenure: 18 years Independent Director Nexstar Board Committee: Other Current Public Company Boards: | I. Martin Pompadur was appointed a member of the Board of Directors of Nexstar in November 2003 and serves as the Chairman of the Nominating and Corporate Governance Committee. Mr. Pompadur served as Global Vice Chairman, Media and Entertainment at Macquarie Capital from 2009 to 2016. Prior to that from 1998 through 2008, Mr. Pompadur worked for News Corporation in a variety of positions including Executive Vice President of News Corporation, President of News Corporation Eastern and Central Europe, as a member of News Corporation’s Executive Management Committee and as Chairman of News Corp. Europe. Mr. Pompadur currently serves as a member of the board of directors of Chicken Soup for the Soul Entertainment (NASDAQ: CSSE), Director of Troika Media Group, Inc. (NASDAQ: TRKA), Director of Golden Falcon Acquisition Corp. (NYSE: GFX), Chairman of Metan Global Entertainment (private), and Director of RP Coffee Ventures (private). Previously, Mr. Pompadur served on the boards of IMAX Corporation, ABC, Inc., Ziff Corporation, News Corporation Europe, Sky Italia, News Out of Home, Balkan Bulgarian, BSkyB, Metromedia International Group, Elong, Seatwave Limited, Linkshare Corporation and Truli Media Group. Mr. Pompadur’s qualifications to serve on Nexstar’s Board of Directors include his extensive expertise in the media industry and his ability to offer a broad international perspective on issues considered by Nexstar’s Board of Directors. | |

Perry A. Sook has served as the Chairman of Nexstar’s Board of

Nexstar Media Group, Inc. | 16 | 2022 Proxy Statement |

Directors President and Chief Executive Officer and as a director since its inception in 1996. From 1991 to 1996, Mr. Sook was a principal of Superior Communications Group. Mr. Sook currently serves as Chairman of the CBS Affiliates Board and The Ohio University Foundation Board. He is also a Board Member of the National Association of Broadcasters, Broadcasters Foundation of America and the Television Bureau of Advertising, where he also previously served as Chairman of the Board of Directors.

Mr. Sook brings to Nexstar’s Board of Directors his demonstrated leadership skills and extensive operating executive experience acquired in several communication and media businesses. He is highly experienced in driving operational excellence, development of innovative technologies and attainment of financial objectives under a variety of economic and competitive conditions.

Geoff Armstrong has served as a director of Nexstar since November 2003. Mr. Armstrong is Chief Executive Officer of 310 Partners, a private investment firm. From March 1999 through September 2000, Mr. Armstrong was the Chief Financial Officer of AMFM, which was publicly traded on the New York Stock Exchange until it was purchased by Clear Channel Communications in September 2000. From June 1998 to February 1999, Mr. Armstrong was Chief Operating Officer and a director of Capstar Broadcasting Corporation, which merged with AMFM in July 1999. Mr. Armstrong was a founder of SFX Broadcasting, which went public in 1993, and subsequently served as Chief Financial Officer, Chief Operating Officer and a director until the company was sold in 1998 to AMFM. Mr. Armstrong has served as a director and the chairman of the audit committee of Urban One (formerly Radio One) since June 2001 and May 2002, respectively. Mr. Armstrong has also served on the board of directors of SFXii Entertainment, Capstar Broadcasting Corporation, AMFM and SFX Broadcasting.

Mr. Armstrong brings to Nexstar’s Board of Directors his extensive experience as the Chief Executive Officer of several publicly traded companies in the broadcast and communications industry, as well as a member of the audit committee of several publicly traded companies. His service on the boards of public companies in diverse industries allows him to offer a broad perspective on corporate governance, risk management and operating issues facing corporations today.

Jay M. Grossmanhas served as a director of Nexstar since 1997 and was its Vice President and Assistant Secretary from 1997 until March 2002. Mr. Grossman serves as Managing Partner and Co-Chief Executive Officer at ABRY Partners, LLC (“ABRY”), which he joined in 1996. Prior to joining ABRY, Mr. Grossman was an investment banker specializing in media and entertainment at Kidder Peabody and at Prudential Securities. Mr. Grossman currently serves as a director (or the equivalent) of several private companies including Hometown Cable, Grande Communications Networks and RCN Telecom Services. Previously, Mr. Grossman served on the board of directors of a wide variety of companies including Atlantic Broadband, Q9 Networks, Sidera Networks, WideOpenWest Holdings, Consolidated Theaters, Country Road Communications, Monitronics International, Caprock Communications, Cyrus One Networks, Executive Health Resources and Hosted Solutions.

Mr. Grossman brings to Nexstar’s Board of Directors his ability to provide the insight and perspectives of a former investment banker at one of the world’s largest investment banks. His prior experience with media and entertainment transactions offers a unique viewpoint as a director. He also oversaw the integration of two middle-market communications companies with differing operations and networks. His service on the boards of several private companies in diverse industries allows him to offer a broad perspective on corporate governance, compensation and operating issues facing corporations today.

Dennis A. Miller – biographical information for Mr. Miller can be found under “Proposal 1 – Election of Class II Directors.”

John R. Muse – biographical information for Mr. Muse can be found under “Proposal 1 – Election of Class II Directors.”

I. Martin Pompadur – biographical information for Mr. Pompadur can be found under “Proposal 1 – Election of Class II Directors.”

Dennis J. FitzSimons was appointed a member of the Board of Directors of Nexstar effective in January 2017. Mr. FitzSimons has served since 2004 as Chairman of the Chicago-based Robert R. McCormick Foundation, a charitable organization with extensive assets. Prior to that, Mr. FitzSimons was the Chief Executive Officer of Tribune Company from 2003 to 2007 and Chairman from 2004 to 2007, stepping down upon completing the sale of the company. In December 2008, Tribune Company filed a voluntary petition under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware and emerged from the related bankruptcy proceedings in December 2012. Mr. FitzSimons began his 25-year career at Tribune in 1982, spending his first 17 years in the broadcast division in positions of increasing responsibility, including General Manager of WGN-TV, Chicago, and President/Chief Executive Officer of Tribune Broadcasting. He was appointed Executive Vice President of Tribune Company in January 2000, with responsibility for the company's broadcasting, publishing and digital groups, as well as the Chicago Cubs Major League Baseball team. He was elected to the Tribune Company board of directors in 2000 and named President and Chief Operating Officer in July 2001 before becoming CEO in January 2003 and Chairman in January 2004. He started his media career at Grey Advertising in New York.

Mr. FitzSimons is a Trustee of both Northwestern University and Chicago’s Museum of Science and Industry. From 2009 until January 2017, Mr. Fitzsimons served on the board of directors of Media General as Chairman of Media General’s Compensation Committee and a member of the Audit Committee. He also served in the board of directors and was a member of the audit committee and the compensation committee, of Time, Inc. from 2014 until its sale to Meredith Corporation in January 2018. Mr. FitzSimons also chaired the Media Security and Reliability Council for the U.S. Federal Communications Commission from 2002 to 2004 and served as a Director of The Associated Press from 2004 to 2007.

Mr. FitzSimon’s qualifications to serve on Nexstar’s Board of Directors include his extensive experience as the Chief Executive Officer of a publicly traded company in the broadcast industry, as well as a member of the audit committee and compensation committee of several publicly traded companies. His service on the boards of public companies allows him to offer a broad perspective on corporate governance, risk management and operating issues facing corporations today.

C. Thomas McMillenhas served as a director of Nexstar since July 2014 and is currently a member of the Board’s Nominating and Corporate Governance Committee. Mr. McMillen currently serves as Chief Executive Officer and President of the LEAD1 Association (formerly the DIA Athletic Directors Association) since September 2015. He has also served on the board of RCS Capital Corporation from May 2013 to May 2016. In January 2016, RCS Capital Corporation filed for Chapter 11 bankruptcy protection in United States Bankruptcy Court for the District of Delaware under a prearranged plan with the consent of the majority of its creditors. Mr. McMillen served as Timios National Corporation’s (formerly Homeland Security Capital Corporation) Chief Executive Officer and Chairman of the Board from August 2005 and served as its President from July 2011 to February 2014. From May 2011 to July 2013, Mr. McMillen served as Chairman of the National Foundation on Fitness, Sports and Nutrition, a Congressionally authorized foundation where he currently serves as Treasurer. From 2010 to 2012, Mr. McMillen was the sole member and manager of NVT License Holdings, LLC (commonly known as New Vision Television), a Delaware limited liability company, which was the indirect parent and controlling entity of several other limited liability companies which held the Federal Communications Commission licenses for eight full power and two low power television stations in eight different television markets. From April 2007 until June 2015, he served on the Board of Regents of the University of Maryland System. From December 2004 until January 2007, Mr. McMillen served as the Chairman of Fortress America Acquisition Corporation (now Fortress International Group, Inc., FIGI.PK), and from January 2007 until August 2009, he served as Vice Chairman and director. From October 2007 until October 2009, Mr. McMillen served as Chairman and Co-Chief Executive Officer of Secure America Acquisition Corporation (now Ultimate Escapes, Inc. OTCBB: ULEIQ.PK), and from October 2009 to December 2010 as a director and from November 2009 to December 2010 as Vice Chairman. Ultimate Escapes, Inc. filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the District of Delaware in September 2010. From 1987 through 1993, Mr. McMillen served three consecutive terms in the U.S. House of Representatives representing the 4th Congressional District of Maryland. Mr. McMillen received a Bachelor of Science in Chemistry from the University of Maryland and a Bachelor and Master of Arts from Oxford University as a Rhodes Scholar.

Mr. McMillen’s qualifications to serve as a director of Nexstar include his over 28 years of political, business and sports experience and leadership. During his career, he has been an active investor, principal and board member in companies in the cellular, paging, healthcare, motorcycle, environmental technology, broadcasting, real estate and insurance industries.

Lisbeth McNabb has served as a director of Nexstar since May 2006 and is the chair of the audit committee. Ms. McNabb is the Chief Financial Officer and Chief Operating Officer of Linux Foundation since 2018, the organization of choice for the world's top developers and companies to build and advance open source technology. Ms. McNabb was interim Chief Financial Officer for Illuminate Education in 2017 and founder of DigiWorksCorp, a Digital and Data Analytics SaaS company, for Retail and Enterprise companies, where she served as President from 2012 to 2015. Chairman and founder of w2wlink, a professional women’s online membership community, from March 2007 to 2015. Ms. McNabb is the former Chief Financial Officer of Match, a global online dating company, where she was employed from 2005 through 2006. Prior to joining Match, Ms. McNabb served as Senior Vice President of Finance and Planning for Sodexo, a food service and facilities management company, from 2000 to 2005. Prior to that she held innovation, finance and strategy leadership roles with PepsiCo Frito-Lay, American Airlines, AT&T and JP Morgan Chase. Ms. McNabb currently serves on advisory boards of technology companies, and the University of Nebraska Business School. Previously Ms. McNabb served as a director and chair of the audit committee and compensation committee of Tandy Brands and served on the advisory board of American Airlines, Southern Methodist Cox School of Business, Dallas Chapter of Financial Executives International, Sammons Art Center, 4Word and The Family Place.

Ms. McNabb’s brings to Nexstar’s Board of Directors her leadership skills in entrepreneurial and executive roles in media, digital and technology companies and extensive strategy, analytics, operations, finance and marketing experience in a wide range of industries and in marketing to women and diversity. In addition to her leadership experience in digital and technology companies, Ms. McNabb also has had financial leadership roles.

The following provides information regarding the members of our Board, including certain types of knowledge, skills, business experiences, attributes or self-identified specific diversity possessed by one or more of our directors which our Board believes are relevant to our business and industry. The table below does not encompass all of the knowledge, skills, business experiences or attributes of our directors, and the fact that a particular knowledge, skill, business experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill, business experience or attribute with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill, business experience listed below may vary among the members of the Board. The information has been collected from each of our board members and they have voluntarily self-identified their gender and demographic background.

| Sook | Armstrong | Aulestia | FitzSimons | Grossman | McMillen | McNabb | Miller | Muse | Pompadur |

Knowledge, Skills and Experience |

|

|

|

|

|

|

|

|

|

|

Public Company Board Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Financial/Capital Market | ✔ | ✔ |

|

|

| ✔ | ✔ | ✔ | ✔ | ✔ |

Risk Management | ✔ | ✔ |

| ✔ |

|

| ✔ |

| ✔ | ✔ |

Accounting | ✔ | ✔ |

|

|

|

| ✔ |

| ✔ |

|

Corporate Governance/Ethics | ✔ | ✔ |

| ✔ |

| ✔ | ✔ | ✔ | ✔ | ✔ |

Legal/Regulatory | ✔ | ✔ |

|

|

|

| ✔ | ✔ |

| ✔ |

Human Resources/Compensation | ✔ | ✔ |

| ✔ |

|

| ✔ | ✔ | ✔ | ✔ |

Executive Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| ✔ |

Operations Experience | ✔ | ✔ | ✔ | ✔ |

|

| ✔ | ✔ |

| ✔ |

Brand Marketing | ✔ |

| ✔ |

|

|

|

|

|

| ✔ |

Strategic Planning/Oversight | ✔ |

| ✔ | ✔ |

|

| ✔ | ✔ | ✔ | ✔ |

Digital/Technology | ✔ | ✔ | ✔ |

|

|

| ✔ | ✔ |

|

|

Mergers and Acquisitions | ✔ | ✔ |

| ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Media/Broadcast | ✔ | ✔ | ✔ | ✔ | ✔ |

| ✔ | ✔ | ✔ | ✔ |

Academic/Education | ✔ | ✔ |

|

|

|

| ✔ | ✔ |

|

|

Board Tenure |

|

|

|

|

|

|

|

|

|

|

Years of Service | 26 | 18 | 1 | 5 | 25 | 7 | 16 | 8 | 5 | 18 |

Age | 64 | 64 | 49 | 71 | 62 | 69 | 61 | 64 | 71 | 86 |

Board Diversity Matrix (As of [•], 2022) | ||||

Total Number of Directors | 10 | |||

| Female | Male | Non-Binary | Did not Disclose Gender |

Part I: Gender Identity | ||||

Directors | 2 | 8 | — | — |

Number of Directors who identify in Any of the Categories Below: | ||||

Part II: Demographic Background | ||||

African American or Black | — | — | — | — |

Alaskan Native or Native American | — | — | — | — |

Asian | — | — | — | — |

Hispanic or Latinx | 1 | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — |

|

White or Caucasian | — | 9 | — | — |

Two or More Races or Ethnicities | — | — | — |

|

LGBTQ+ | — | |||

Did not Disclose Demographic Background | — | |||

Nexstar Media Group, Inc. | 17 | 2022 Proxy Statement |

CORPORATE GOVERNANCEGOVERNANCE

Committees of the Board of Directors

The Board of Directors currently has three standing committees with the following members:

|

| Compensation |

| Audit |

| Nominating and Corporate Governance |

Geoff Armstrong |

| Chairperson |

|

| ||

Bernadette S. Aulestia | ✔ | |||||

Dennis J. FitzSimons | ✔ |

|

| |||

Jay Grossman |

|

|

|

| ||

C. Thomas McMillen | ✔ | |||||

Lisbeth McNabb | ✔ |

|

| |||

Dennis A. Miller |

|

|

|

|

|

|

John R. Muse |

|

|

|

|

|

|

I. Martin Pompadur |

|

|

|

|

| Chairperson |

|

| |||||

|

| |||||

|

|

Compensation Committee

The purpose of the Compensation Committee is to establish compensation policies for Directors and executive officers of Nexstar, approve employment agreements with executive officers of Nexstar, administer Nexstar’s stock optionstock-based compensation plans and approve grants under the plans and make recommendations regarding any other incentive compensation or equity-based plans. The Compensation Committee makes decisions about the compensation of the Chief Executive Officer and has the authority to review and approve the compensation policies for the Company’s other executive officers. The primary objectives of the Compensation Committee in determining total compensation (both salary and incentives) of the Company’s executive officers, including the Chief Executive Officer, are (i) to enable the Company to attract and retain highly qualified executives by providing total compensation opportunities with a combination of elements which are at or above competitive opportunities, (ii) to tie executive compensation to the Company’s general performance and specific attainment of long-term strategic goals, and (iii) to provide long-term incentives for future performance that aligns stockholder interests and executive rewards.

The Compensation Committee telephonically met twice during 2019.2021. The Compensation Committee also passed a number of resolutions in lieu of holding meetings with the Committee during 2019. In addition, succession planning, the negative say on pay vote, and other committee items were discussed as part of full board executive sessions.2021. The Compensation Committee operates under an amendeda written charter adopted by the Board of Directors in April 2017. A copy of such charter is available through our web sitewebsite at www.nexstar.tv. The information contained on or accessible through our web sitewebsite does not constitute a part of this Proxy Statement. All three members of the Compensation Committee are “independent” as that term is defined in the NASDAQ Stock Market Marketplace rules. For more information regarding the Compensation Committee, please refer to the “Compensation Committee Report” in this Proxy Statement.

Audit Committee

The purpose of the Audit Committee is to oversee the quality and integrity of Nexstar’s accounting, internal auditing and financial reporting practices, to perform such other duties as may be required by the Board of Directors, and to oversee Nexstar’s relationship with its independent registered public accounting firm. The Audit Committee met four times during 2019. The2021. All three members of the Audit Committee are “independent” as that term is defined in the NASDAQ Stock Market Marketplace rules. The Board of Directors has determined that Ms. McNabb,Mr. Geoff Armstrong, who served as Chair of the Audit Committee in 2019,since October 20, 2020, is an “audit committee financial expert” in accordance with the applicable rules and regulations of the United States Securities and Exchange Commission (the “SEC”). The Audit Committee operates under an amendeda written charter adopted by the Board of Directors in April 2017. A copy of such charter is available through our web sitewebsite at www.nexstar.tv. The information contained on or accessible through our website does not constitute a part of this Proxy Statement. For more information regarding the Audit Committee, please refer to the “Audit Committee Report” in this Proxy Statement.

Nexstar Media Group, Inc. | 18 | 2022 Proxy Statement |

Corporate Governance

Nominating and Corporate Governance Committee

The purpose of the Nominating and Corporate Governance Committee is to identify individuals qualified to serve on Nexstar’s Board of Directors, recommend persons to be nominated by the Board of Directors for election as directors at the annual meeting of stockholders, recommend nominees for any committee of the Board of Directors, develop and recommend to the Board of Directors a set of corporate governance principles applicable to Nexstar and to oversee the evaluation of the Board of Directors and its committees. The Nominating and Corporate Governance Committee operates under an amendeda written charter adopted by the Board of Directors in April 2017. A copy of such charter is available through our web sitewebsite at www.nexstar.tv. The information contained on or accessible through our website does not constitute a part of this Proxy Statement. All three members of the Nominating and Corporate Governance Committee are “independent” as that term is defined in the NASDAQ Stock Market Marketplace rules. The Nominating and Corporate Governance Committee did not meet as a committee in 2019met once during 2021 because all material committee issues were discussed by the full Board of Directors during executive sessions. Our Nominating and Corporate Governance Committee will consider stockholder nominees for the Board of Directors (see “Stockholder Proposals for the 20212023 Annual Meeting” under “Other Information” in this Proxy Statement).

Additional Information Concerning the Board of Directors

During 2019,2021, the full Board of Directors met five times. As summarized in the table below, each incumbent director attended more than 75%100% of the total number of meetings of the Company’s Board of Directors and committees of the Board of Directors on which they serve.

| Meetings Attended |

|

|

|

| |||||||||||||||||||||

|

|

|

|

|

|

| Nominating and |

|

|

|

|

|

| |||||||||||||

|

|

|

| Compensation |

| Audit |

| Corporate Governance |

|

|

| Overall |

|

| Meetings Attended |

|

| |||||||||

|

| Full Board |

| Committee(1) |

| Committee(2) |

| Committee(3) |

| Total |

| Attendance |

|

| Full Board |

| Compensation Committee(1) |

| Audit Committee(2) |

| Nominating and Corporate Governance Committee(3) |

| Total |

| Overall Attendance | |

Perry A. Sook |

| 5 |

|

|

|

|

|

|

| 5 |

| 100% |

|

| 5 |

|

|

|

|

|

|

| 5 |

| 100% | |

Geoff Armstrong |

| 5 |

| 2 |

| 4 |

|

|

| 11 |

| 100% |

|

| 5 |

|

|

| 4 |

|

|

| 9 |

| 100% | |

Bernadette S. Aulestia |

| 5 |

| 2 |

|

|

|

|

| 7 |

| 100% | ||||||||||||||

Jay M. Grossman |

| 4 |

| 2 |

|

|

|

|

| 6 |

| 86% |

|

| 5 |

| 2 |

|

|

|

|

| 7 |

| 100% | |

Dennis A. Miller |

| 5 |

| 2 |

|

|

|

|

| 7 |

| 100% |

|

| 5 |

| 2 |

|

|

|

|

| 7 |

| 100% | |

John R. Muse |

| 5 |

|

|

|

|

|

|

| 5 |

| 100% |

|

| 5 |

|

|

|

|

| 1 |

| 6 |

| 100% | |

I. Martin Pompadur |

| 4 |

|

|

|

|

|

|

| 4 |

| 80% |

|

| 5 |

|

|

|

|

| 1 |

| 6 |

| 100% | |

Dennis J. FitzSimons |

| 4 |

|

|

| 4 |

|

|

| 8 |

| 89% |

|

| 5 |

|

|

| 4 |

|

|

| 9 |

| 100% | |

C. Thomas McMillen |

| 5 |

|

|

|

|

|

|

| 5 |

| 100% |

|

| 5 |

|

|

|

|

| 1 |

| 6 |

| 100% | |

Lisbeth McNabb |

| 5 |

|

|

| 4 |

|

|

| 9 |

| 100% |

|

| 5 |

|

|

| 4 |

|

|

| 9 |

| 100% | |

(1) | The Compensation Committee met twice during |

(2) | The Audit Committee met four times during |

(3) | The Nominating and Corporate Governance Committee |

Nexstar Media Group, Inc. | 19 | 2022 Proxy Statement |

Corporate Governance

The Board of Directors has not adopted a formal policy with regard to director attendance at the annual meeting of stockholders because fewer than ten non-management stockholders attended our 20192021 Annual Meeting of Stockholders in person.virtual-only format. Mr. Sook attended and presided over the 20192021 virtual Annual Meeting of Stockholders.

The Nominating and Corporate Governance Committee determines the minimum qualifications that Director nominees must possess based on the composition, size and needs of the Board of Directors. The Nominating and Corporate Governance Committee also determines the qualifications and skills required to fill a vacancy or a newly created directorship to complement the existing qualifications and skills, as a vacancy or need for a new directorship arises. The nomination procedures include the review of stockholder nominations for candidacy to the Board of Directors, review of succession planning with the Compensation Committee, review of the desirability of term limits of the Board of Directors and establishment of guidelines for removal of directors.Directors. If it is determined that an additional nominating policy would be beneficial to Nexstar, the Board of Directors may in the future adopt an additional nominating policy.

The Nominating and Corporate Governance Committee reviews the succession planning with the Compensation Committee, reviews of the desirability of term limits of the Board of Directors and establishment of guidelines for removal of directors.

There is no formal policy governing how diversity is considered in the makeup of the Board and the selection of its members. The Nominating and Corporate Governance Committee defines Board diversity broadly to mean that the Board is comprised of individuals with a variety of perspectives, industry experience, personal and professional backgrounds, skills and qualifications. When nominating a Board member, the Nominating and Corporate Governance Committee examines the diversity of the overall board and strives to maintain an appropriate level of diversity (as set forth above) with the addition of each new nominee.

Under the rules and regulations of the NASDAQ Stock Market, we are required to maintain a majority of independent Directors on the Board of Directors and to have the compensation of our executive officers and the nomination of Directors be determined by independent Directors. Our Board of Directors meets these standards.

In the first quarter of 2022, members of senior management, with support from JCIR, a third-party consultant, targeted the Company’s top 24 non-affiliated institutional investors to discuss the Company’s ongoing corporate governance, social responsibility and environmental activities (hereinafter collectively referred to as “ESG”) as well as any other issues important to stockholders. The targeted 24 non-affiliated institutional investors had a combined voting authority of approximately 24.3 million shares, or approximately 59% of the voting shares of Nexstar as of December 31, 2021. Of the 24 institutional investors, conference calls were conducted with 15 who collectively held a combined voting authority of 15 million shares, or approximately 37% of the Company’s voting shares. The remaining nine institutional investors, who collectively held approximately 22% of the Company’s voting shares, either did not require ESG calls, did not respond to our invitations for an ESG call or do not engage with company management about ESG matters. Our President and Chief Operating Officer, Executive Vice President, General Counsel and Secretary and Executive Vice President and Chief Financial Officer participated in these conference calls and discussed matters on ESG and other corporate governance matters. The Chairperson of the Company’s Compensation Committee participated on calls with seven of the Company’s 15 largest institutional investors representing approximately 27% of Nexstar voting shares.

The majority of the investors commented positively on the opportunity to directly discuss with management the Company’s initiatives on ESG and other items of importance to them. Common themes expressed by the surveyed stockholders were an appreciation for the work of the Company’s executives related to capital allocation, operating performance of the Company and the returns generated for stockholders. The investors also provided positive feedback on our commitment to good governance.

Nexstar Media Group, Inc. | 20 | 2022 Proxy Statement |

Corporate Governance

Below is a summary of the recurring recommendations we received through our 2022 outreach involving ESG and our responses:

What We Heard from Stockholders During Our 2022 Outreach | Our Perspective / How We Responded | |

Appointment of a lead independent director; Separation of CEO and Chairperson roles | • Our CEO is a top ten stockholder of the Company and his interests are aligned with our stockholders. • All Board members, except for the Chairperson are independent. • All members of our Board work well together and each member effectively interacts directly with our CEO and our management. • The Board's view is that a lead independent director would diminish the varying inputs that each director brings to the overall Board. • Senior management succession planning is in progress which will provide an opportunity to consider the separation of CEO and Chairperson roles in the future. | |

Diversification and refreshment of the Board | • In January 2021, we expanded our Board to 10 members with the addition of Ms. Aulestia, who brings digital and media expertise to the Board and adds gender and ethnic diversity. • We anticipate that our Board will go through a refreshment process in the future which will provide an opportunity to increase the diversity of our Board composition in terms of age, gender and ethnicity. | |

Enhance stockholder rights by considering declassification of the Board, the addition of either the right to act by written consent, the right to call for a special meeting or the right to proxy process | • As part of our future Board refreshment process, the Board will consider a declassification of the Board among other stockholder rights. | |

Company should adopt an ESG framework guided by established sustainability standards and expand disclosures of ESG matters in the proxy statement | • We are in process of adopting an ESG framework and reporting using the Sustainability Accounting Standards Board (“SASB”) as our baseline to establish performance criteria that are salient to us and that support our long-term strategy. • We have expanded our “Corporate Social Responsibility" disclosures below for new and ongoing initiatives. • We have expanded our disclosures of our Board’s skills, experiences, and attributes, including diversity, in the “Board of Directors Matrix” section above. • Concurrent with this filing, we have made available 2020 EEO-1 data and will make available the 2021 EEO-1 data on our website regarding our employee composition when it is available later this spring/summer. |

Nexstar Media Group, Inc. | 21 | 2022 Proxy Statement |

Corporate Governance

What We Heard from Stockholders During Our 2022 Outreach | Our Perspective / How We Responded | |

Increase the total stockholder return performance period of restricted stock units from two years to three years | • The Company’s two-year stockholder return performance period is based on the country's two-year election cycle. The Company generates significant revenue from political advertising in even-years in which elections are typically conducted which positively impacts the Company’s profitability. If the performance period were extended to three from two years, the incentive period may include two election years or two non-election years which would not be aligned with the financial cycle of the Company. | |

Add a clawback policy to recall executive compensation resulting from a termination with a cause | • The Company intends to comply with any clawback rules adopted by the SEC in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The SEC reopened the comment period for its proposed clawback rules in October 2021. |

Board of Directors Leadership Structure

The Board of Directors has the responsibility for selecting the appropriate leadership structure for the Company. In making leadership structure determinations, the Board of Directors considers many factors, including the specific needs of the business and the best interests of the Company’s stockholders. Our current leadership structure is comprised of a combined Chairman of the Board and Chief Executive Officer and Board committees comprised of independent Directors. The Board of Directors believes that Mr. Sook’s service in this combined role is in the best interest of both the Company and its stockholders. Mr. Sook has a vast knowledge of television broadcasting and is seen as a leader in this industry. He understands the issues facing the Company and serving in this dual role he is able to effectively focus the Board of Director’s attention on these matters. In his combined capacity, he can speak clearly with one voice in addressing the Company’s various stakeholders such as customers, suppliers, employees and the investing public.

All of the Company’s directors, except for the Chairman, are independent. The Board of Directors has voted not found the need to designate one of the independent Directors as a “lead independent director” because each independent Director is fully and effectively involved in the activities and issues relevant to the Board of Directors and its committees. The independent directors do not wish to place one individual between themselves and the Chairman/CEOChairman of the Board and Chief Executive Officer and other management as they believe this will diminish their active engagement. The independent Directors have repeatedly demonstrated the ability to exercise their fiduciary responsibilities in deliberating issues before the Board of Directors and making independent decisions. Under NASDAQ Listing Standards, our independent Directors are Messrs. Armstrong, Grossman, Pompadur, Miller, Muse, FitzSimons and McMillen and Ms.Mses. Aulestia and McNabb.

Nexstar Media Group, Inc. | 22 | 2022 Proxy Statement |

Corporate Governance